-

find a LAWYER

-

Choose a lawyer near you

Choose your state

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

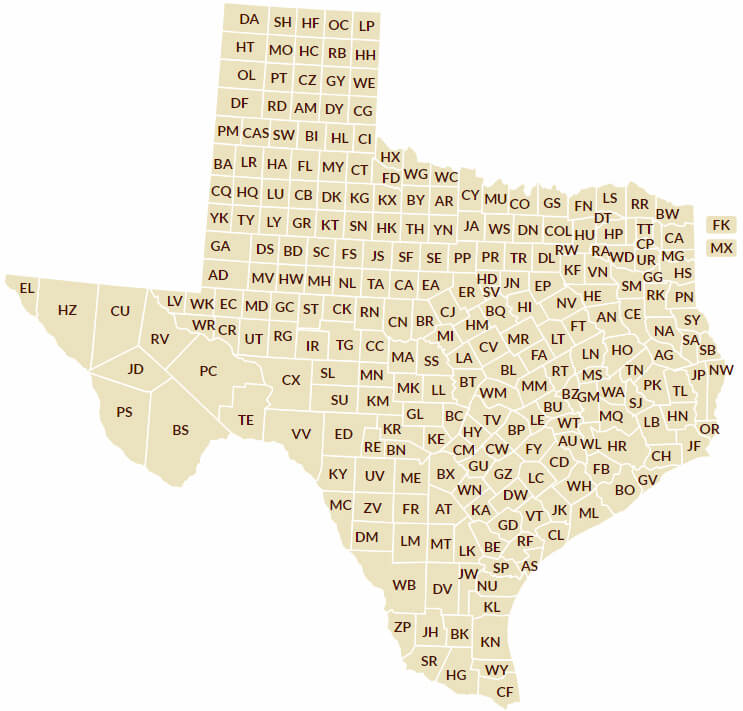

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- Choose a lawyer by practice area

-

Choose a lawyer by specialty

- National Board Certifications

-

State Board Certifications

- State Bar of Arizona Board of Legal Specialization

- California Board of Legal Specialization

- Connecticut Bar Association

- Florida Bar Board of Legal Specialization and Education

- Louisiana Board of Legal Specialization

- Minnesota State Bar Association

- New Jersey Board on Attorney Certification

- North Carolina State Bar Board of Legal Specialization

- Ohio State Bar Association

- Texas Board of Legal Specialization

-

Choose a lawyer near you

-

legal COMMUNITY

-

Nonprofit Legal Associations

-

National Legal Associations

- American Association for Justice (AAJ)

- American Immigration Lawyers Association (AILA)

- Maritime Law Association of the United States (MLAUS)

- National Association of Consumer Bankruptcy Attorneys (NACBA)

- National Association of Criminal Defense Lawyers (NACDL)

- National College for DUI Defense (NCDD)

- National Employment Lawyers Association (NELA)

- National Organization for the Reform of Marijuana Laws (NORML)

- More…

- Bar Associations by State

-

Civil Justice / Trial Lawyers Associations

- Consumer Attorneys of California

- Florida Justice Association

- Georgia Trial Lawyers Association

- Indiana Trial Lawyers Association

- Iowa Association for Justice

- Kentucky Justice Association

- Minnesota Association for Justice

- New Mexico Trial Lawyers Association

- New York State Trial Lawyers Association

- Tennessee Association for Justice

-

Criminal Defense Lawyers Associations

- California Attorneys for Criminal Justice

- Colorado Criminal Defense Bar

- Florida Association of Criminal Defense Lawyers

- Georgia Association of Criminal Defense Lawyers

- Louisiana Association of Criminal Defense Lawyers

- Criminal Defense Attorneys of Michigan

- New York State Association of Criminal Defense Lawyers

- Ohio Association of Criminal Defense Lawyers

- Pennsylvania Association of Criminal Defense Lawyers

- Texas Criminal Defense Lawyers Association

- More…

-

National Legal Associations

-

Lawyer Insights

- Legal Resources and Services

-

Nonprofit Legal Associations

- SIGN IN

-